To pay contribution on higher wages a joint request from Employee and employer is required Para 266 of EPF Scheme. CPF Contribution Rate From 1 January 2016 Table for Private Sector Non-Pensionable Employees Ministries Statutory Bodies Aided Schools.

Confluence Mobile Support Wiki

This KBA 2484659 was created specially to elaborate on the above legal change on top of the SAP solution Note.

. This is the lowest PF interest rate in the past four decades. Reduction in Employees EPF Statutory Contribution Rate 2016 The EPF Board Malaysia has announce a decrease of Employee Contribution Rate from 11 to 8 while for Senior Citizen it will be changed from 55 to 4. Since then the interest on PF contributions has been 825 or more.

In 1977-70 the EPFO offered 8 interest on EPF contributions. In such case employer has to pay administrative charges on the higher wages wages above 6500-. The employees provident fund is currently offered for an interest rate of 81 per annum.

Written by Rajeev Kumar Updated. Following Prime Minister YAB Datuk Seri Najib Tun Abdul Razaks announcement during the presentation of the revision of Budget 2016 today the Employees Provident Fund EPF announces the reduction in the employees monthly statutory contribution rate from 11 to 8 for members below age 60 and 55 to 4 for those age 60. Since the scheme is governed by the government of India it is a safe and secure investment option for employees offering post-retirement benefits.

Know How steps in a few scenarios in accordance to the above legal change. The employee can pay at a higher rate and in such case employer is not under any obligation to pay at such higher rate. To recommend the rate of interest for the year 2016-17 the status of estimated amount to the credit of the members as on 01042016 budget estimates BE of the Contributions and Withdrawals during 2016-17 and the estimated income from the investment holdings are taken into consideration.

The applicable interest rate on EPF contribution for the financial year 2021-22 is 810. Reduction in Employees EPF Statutory Contribution Rate 2016 The EPF Board Malaysia has announce a decrease of Employee Contribution Rate from 11 to 8 while for Senior Citizen it will be changed from 55 to 4. The only difference would be that employees could choose whether or not to save 12 per cent of their salary into EPF or keep it as take home pay.

For employees with monthly wages exceeding RM20000 the employees contribution rate shall be 9 while the rate of contribution by the employer is 12. The only major difference between the both is that the 12 salary contribution of the employee goes directly to the EPF account whereas the contribution to VPF account should be made separately. In March 2022 the EPFO had proposed to cut the interest rate on provident fund deposits from 85 to 81 for 2021-22.

August 4 2022 5. In 2016 the government has decided to reduce the EMPLOYEE contributions down to 8 hence you will end up with 3 more in your payslip each and every month. Retirement body Employees Provident Fund Organisation EPFO has reduced the rate of interest to 865 per cent in 2016-17 from 88 per.

KUALA LUMPUR 28 January 2016. The contributors have the provision to benefit from the same. 2274897 - 2274897 - LC.

Currently the EMPLOYER has a set rate of 12 each month that MUST be sent to your EPF account. Features and Benefits of the Employee Provident Fund Scheme. The standard practice for EPF contribution by employer and employee are.

Employees Provident Fund Interest Rate Calculation 2022. In 2015 you as the EMPLOYEE would have 11 of your salary deducted. New Delhi Apr 14 2017 Updated Jun 25 2017 421 PM IST.

There are various benefits attached to procuring an Employee Provident Fund scheme for retirement. Employees Provident Fund EPF announces the reduction in the employees monthly statutory contribution rate from 11 to 8 for members below age 60 and 55 to 4 for those age 60 and above. Employer at 12 or 13 whereas employee contributes 11 of monthly salary to the EPF.

To be clear the employers 12 per cent contribution to EPFEPS would be unaffected. Employees total wages for the calendar month Total CPF contributions Employers Employees share Employees share of CPF contributions 55 500 to 750 below 50 Nil Nil 50 to. Employee EPF contribution RM 6600 8 RM 528 Note.

EPF Employee Contribution Rate effective 01032016 - 31122017. Such a change would effectively reduce the tax on formal sector labour while leaving informal sector labour costs. The employee can pay at a higher rate and in such case employer is not under any obligation to pay at such higher rate.

Delimit IT0196 to use Personal Rate 11 01032016 onwards as below.

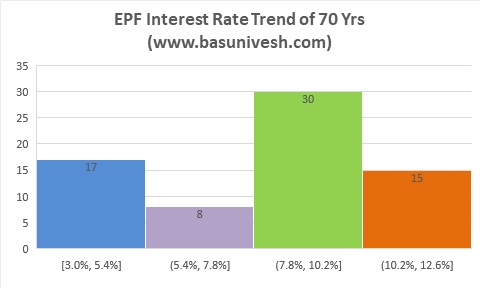

Epf Interest Rate Fy 2021 22 Historical Epf Rates 1952 To 2022 Basunivesh

Invest In Nps Investing How To Plan Nps

Epf Interest Rate Pf Members To Get 8 1 Interest For 2021 22 Lowest Since 1977 78

Epf Interest Rates 2022 Epfo Cuts Interest Rates From 8 5 To 8 1

Confluence Mobile Support Wiki

Epf Interest Rate 2021 22 How To Calculate Interest On Epf

Default Deferral Rates For Dc Plans Get A Nudge Up Pensions Investments

20 Kwsp 7 Contribution Rate Png Kwspblogs

How To Save Capital Gains Tax On Property Sale Capital Gain Capital Gains Tax Tax

Confluence Mobile Support Wiki

Savings Investment Tips 10 Points On Public Provident Fund Ppf Investment What Every Indian Public Provident Fund Investment Tips Savings And Investment

Estimates Of Smoothed Contribution Rates And Associated Trust Funds Download Table

Confluence Mobile Support Wiki

.jpeg)

Epf Interest Rate Cut But Indian S Income Increased Negligibly From 2016

Income Tax Ppt Revised Income Income Tax Tax

Finance Economics The Economist

Epf Interest Rate From 1952 And Epfo